- The average cost to launch an ETF ranges from $100,000 to $1 million.

- The average ETF in the U.S. has approximately $1.9 billion in assets under management.

- Starting an ETF with only one dollar is technically possible but faces significant financial and regulatory challenges.

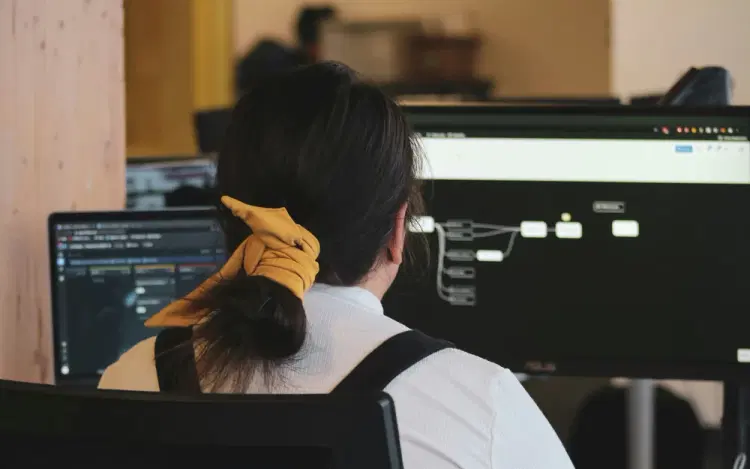

Starting an Exchange-Traded Fund (ETF) with only one dollar may seem like a far-fetched idea, but it is technically possible. ETFs are investment funds traded on stock exchanges, typically tracking an index or commodity. These funds are known for their low costs, diversification benefits, and ease of trading. However, the feasibility of starting an ETF with just one dollar is dependent on several factors.

Creating an ETF requires a considerable amount of capital to cover operational costs such as legal fees, marketing expenses, and regulatory filings. According to industry experts, the average cost to launch an ETF ranges from $100,000 to $1 million. With such high upfront costs, starting an ETF with only one dollar would be virtually impossible.

ETFs are subject to stringent regulatory requirements imposed by the Securities and Exchange Commission (SEC). In order to launch an ETF, the fund sponsor must comply with SEC regulations regarding structure, disclosure, and investor protection. Meeting these regulatory standards requires a significant investment of time and resources, further complicating the prospect of starting an ETF with minimal capital.

The success of an ETF relies heavily on its ability to attract investors and generate sufficient assets under management (AUM). Research shows that the average ETF in the U.S. has approximately $1.9 billion in AUM, highlighting the competitive nature of the industry. In order to compete effectively, ETF sponsors must differentiate their funds through unique investment strategies, low costs, and strong performance track records.

While it may be technically feasible to start an ETF with only one dollar, the practicality and viability of such an endeavor are highly questionable. The high initial costs, regulatory hurdles, and competitive landscape of the ETF industry present significant barriers to entry for aspiring fund sponsors. Ultimately, success in the ETF space requires a strategic and well-funded approach that goes beyond a nominal initial investment.