- The data shows that Canadian venture capital firms have performed well over the past decade, with an average return on investment of around 13%.

- This demonstrates the strength of the Canadian tech ecosystem and the potential for further growth and success in the future.

- However, challenges such as diversity and inclusivity need to be addressed to ensure that the benefits of venture capital funding are accessible to all entrepreneurs.

According to data from the Canadian Venture Capital and Private Equity Association (CVCA), the average return on investment for venture capital firms in Canada over the past 10 years has been around 13%. This figure is slightly lower than the global average of 14%, but still demonstrates a strong track record of success for Canadian firms. It is important to note that these returns can vary significantly depending on the stage of investment and the industry sector.

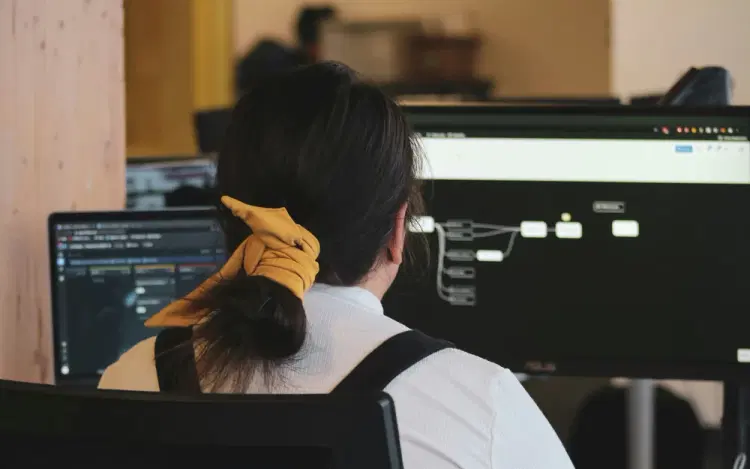

One of the key factors contributing to the success of Canadian venture capital firms is the country's vibrant tech ecosystem, particularly in cities like Toronto, Vancouver, and Montreal. These cities have seen a surge in tech startups in recent years, attracting significant investment from both domestic and international firms. This has led to a steady increase in the number of successful exits and strong returns for investors.

In addition, government support through programs like the Venture Capital Catalyst Initiative (VCCI) has played a crucial role in boosting the venture capital ecosystem in Canada. The VCCI aims to stimulate private sector investment in early-stage Canadian businesses, providing crucial funding and support to help startups scale and succeed. This has led to a significant increase in venture capital activity in Canada, with more firms investing in a diverse range of industries.

Despite the overall success of Canadian venture capital firms, there are still challenges that need to be addressed. One of the main issues is the lack of diversity in the Canadian tech industry, with women and minority founders often facing barriers to accessing funding. While efforts are being made to promote inclusivity and diversity, there is still a long way to go in ensuring that all entrepreneurs have equal opportunities to succeed.