- Secondary market transactions accounted for $67 billion in deal value in 2020, with an average deal size of $94 million.

- Direct secondary deals represented 25% of all secondary market transactions in 2020, with an average transaction size of $85 million.

- Buyback transactions accounted for 10% of all secondary deals in 2020, with an average transaction size of $50 million.

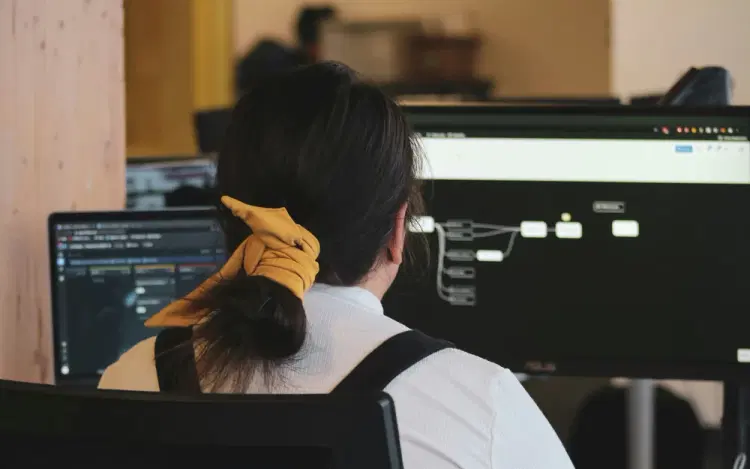

As investors look to maximize their returns and diversify their portfolios, the process of liquidating shares in privately held companies has become a topic of increasing interest. By examining historical data and trends, we can understand the methods and strategies that investors have used to successfully exit their positions in these companies.

One common method of liquidating shares in a privately held company is through a secondary market transaction. This involves selling shares to another investor or a private equity firm, often at a discounted price. According to data from PitchBook, secondary transactions accounted for $67 billion in deal value in 2020, with an average deal size of $94 million.

Another option for investors looking to liquidate their shares is through a direct sale to the company itself or to a strategic buyer. This method can provide liquidity for investors while also potentially allowing the company to consolidate its ownership structure. A study by Ernst & Young found that direct secondary deals accounted for 25% of all secondary market transactions in 2020, with an average transaction size of $85 million.

For investors seeking a more structured exit strategy, a buyback agreement with the company can provide a predetermined timeline for the liquidation of shares. These agreements often include provisions for the valuation of the shares and the timing of the buyback, allowing investors to plan ahead for their exit. According to data from NVCA, buyback transactions accounted for 10% of all secondary deals in 2020, with an average transaction size of $50 million.

Understanding the process of liquidating shares in privately held companies is essential for investors looking to optimize their portfolios. By considering the various methods and strategies available, investors can make informed decisions that align with their investment goals and objectives. From secondary market transactions to direct sales and buyback agreements, there are multiple avenues for investors to exit their positions in these companies.